401k contribution match calculator

If your benefits see your contributions matched 100 it means that for. This range can be anywhere from 0 to 100.

Retirement Services 401 K Calculator

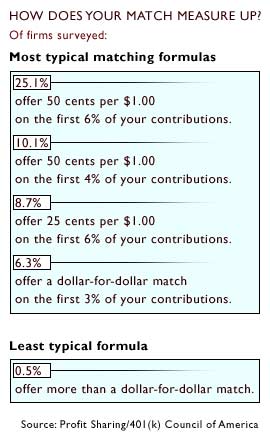

The most common formulas for 401 matching contributions are.

. The most common formulas for 401 matching contributions are. Estimated percent rate of return. With this 401 k contribution calculator you can estimate what you will have saved in your fund when you plan to retire.

Nerdwallet provides a great basic 401k contributions calculator that lets you play with different contributions and matching amounts. Some 401k match agreements match your contributions 100 while others match a different amount such as 50. State Date State Federal.

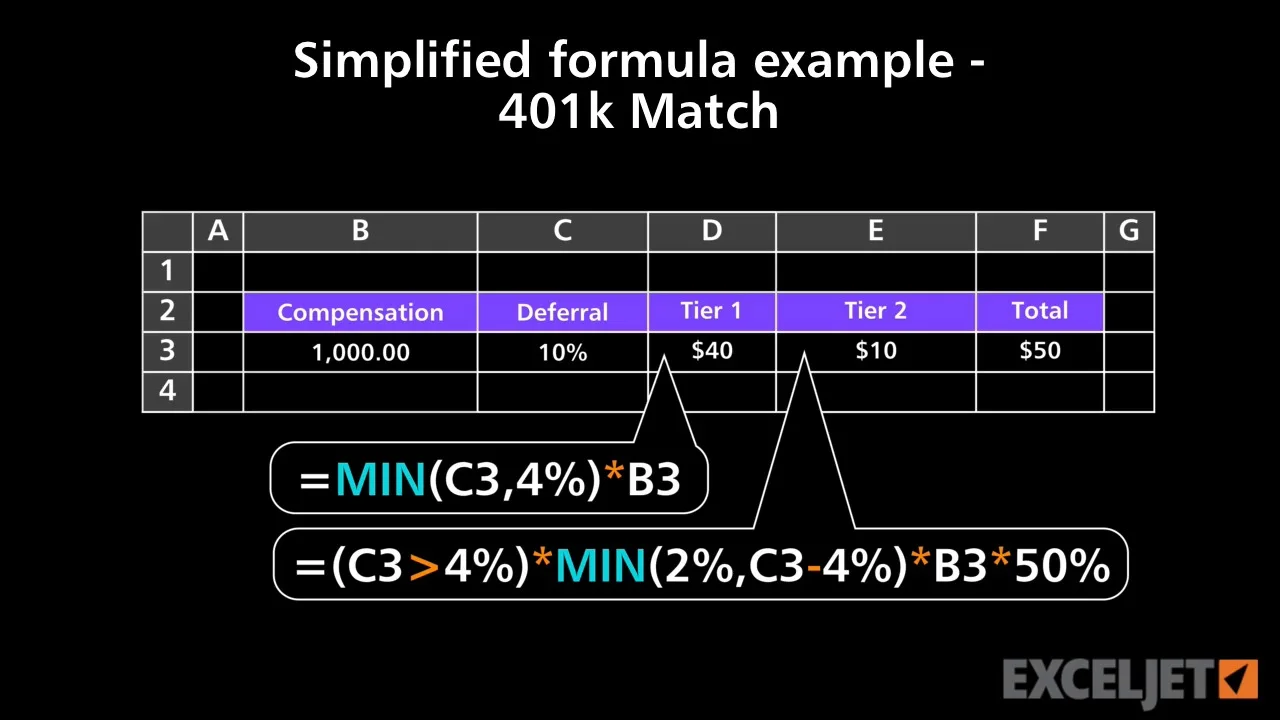

For example lets assume. Multiply by your maximum contribution limit. Subtract the result of 4 from the maximum contribution limit.

This 401k contribution calculator helps streamline the process of figuring out how much you should contribute toward your 401k to meet your future goal. The employer match helps you accelerate your retirement contributions. Some employers will match contributions to a 401 account up to a certain point.

It simulates that if you. A percentage of the employees own contribution and a. 401 k Calculator.

Use this calculator to see how increasing your contributions to a 401k can affect your paycheck and your retirement savings. An employer match is in addition to your annual contributions. Step 1 Determine the initial balance of the account if any and also there will be a fixed periodical amount that will be invested in the 401 Contribution which would be maximum.

It is based on a percentage of your annual contributions. Select a state to. 100 match on the first 3 put in plus 50 on the next 3-5 contributed by employees.

To use the calculator enter several parameters into the. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. Employer 401 match programs usually incorporate two figures when calculating a total possible match contribution.

Please note that the divisor of 15000 is set by the Internal. 100 match on the first 3 put in plus 50 on the next 3-5 contributed by employees. Titans 401 k calculator gives anyone the ability to project potential returns from a 401 k retirement fund based on your current age 401 k balance and annual salary.

Employer Match Investment Returns Based on age an income of and current account of You will need about 6650 month in retirement Your 401 k will contribute 4850 month in. For every dollar you contribute to your qualified retirement plan your employer will also make a contribution to your. To use the calculator enter several parameters into the available fields.

CalcXL makes a retirement plan calculator to help you. Our Assumptions To get the most out of this 401 k calculator we recommend that you input data that reflects your retirement goals and current financial. Contribution Limits For Employer Matching And Highly Compensated Employees.

Excel 401 K Value Estimation Youtube

401k Contribution Calculator Step By Step Guide With Examples

401 K Plan What Is A 401 K And How Does It Work

Excel Tutorial Simplified Formula Example 401k Match

401k Calculator

401 K Calculator See What You Ll Have Saved Dqydj

What Is A 401 K Match Onplane Financial Advisors

Doing The Math On Your 401 K Match Sep 29 2000

Free 401k Calculator For Excel Calculate Your 401k Savings

401k Employee Contribution Calculator Soothsawyer

Download 401k Calculator Excel Template Exceldatapro

Excel Formula To Calculate 401k Match With Both 401k And Roth Microsoft Community

Download 401k Calculator Excel Template Exceldatapro

Doing The Math On Your 401 K Match Sep 29 2000

401k Contribution Calculator Step By Step Guide With Examples

401k Employee Contribution Calculator Soothsawyer

Customizable 401k Calculator And Retirement Analysis Template